Estimated 2022 tax brackets

For purposes of estimating the bills impact on federal budget deficits interest payments and. 4 rows so I should have 2022 tax bracket amounts multiplying inflation adjustment factor by 2018.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

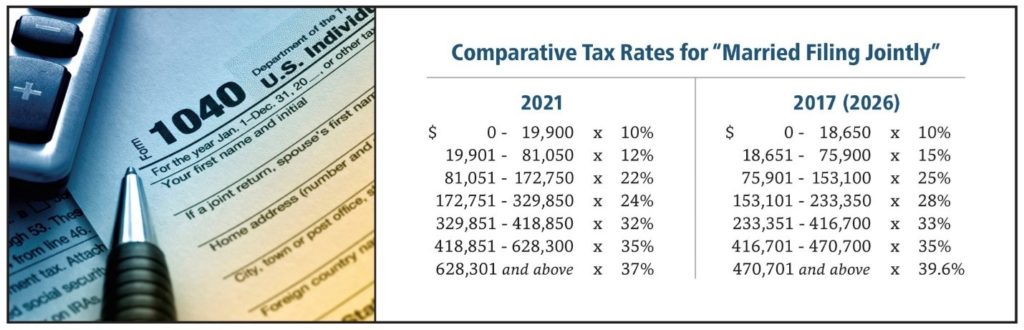

Your 2021 Tax Bracket To See Whats Been Adjusted.

. The filing status for this option is Married Filing Separately. Married couples who file joint tax returns have a 2022 standard. For example in 2021 a single filer with taxable income of 100000 will.

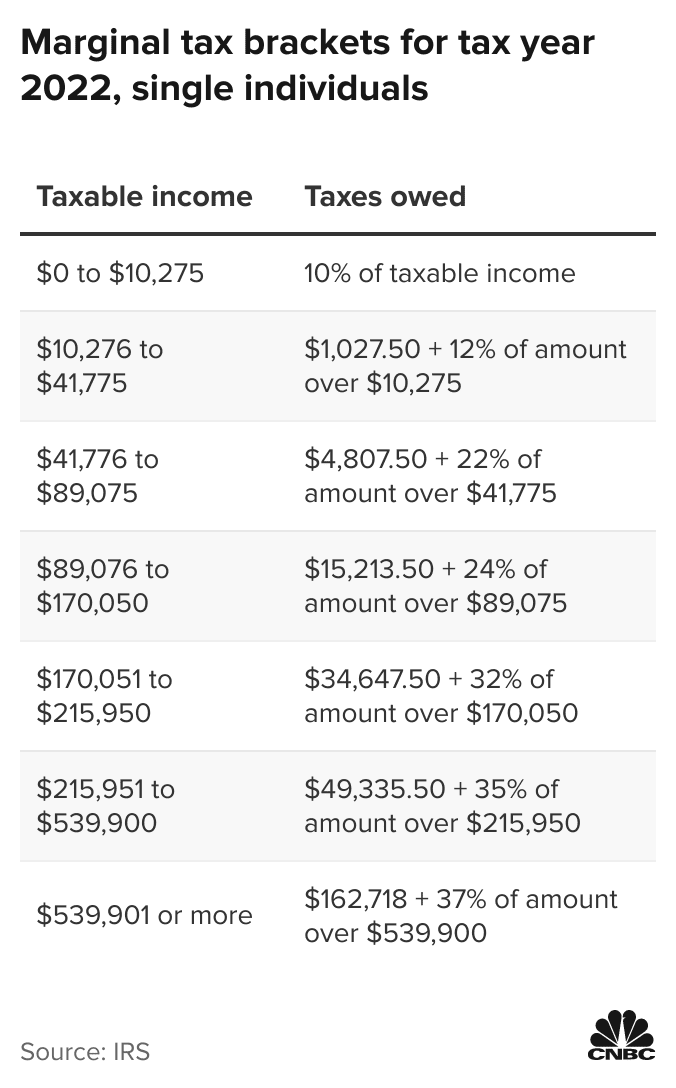

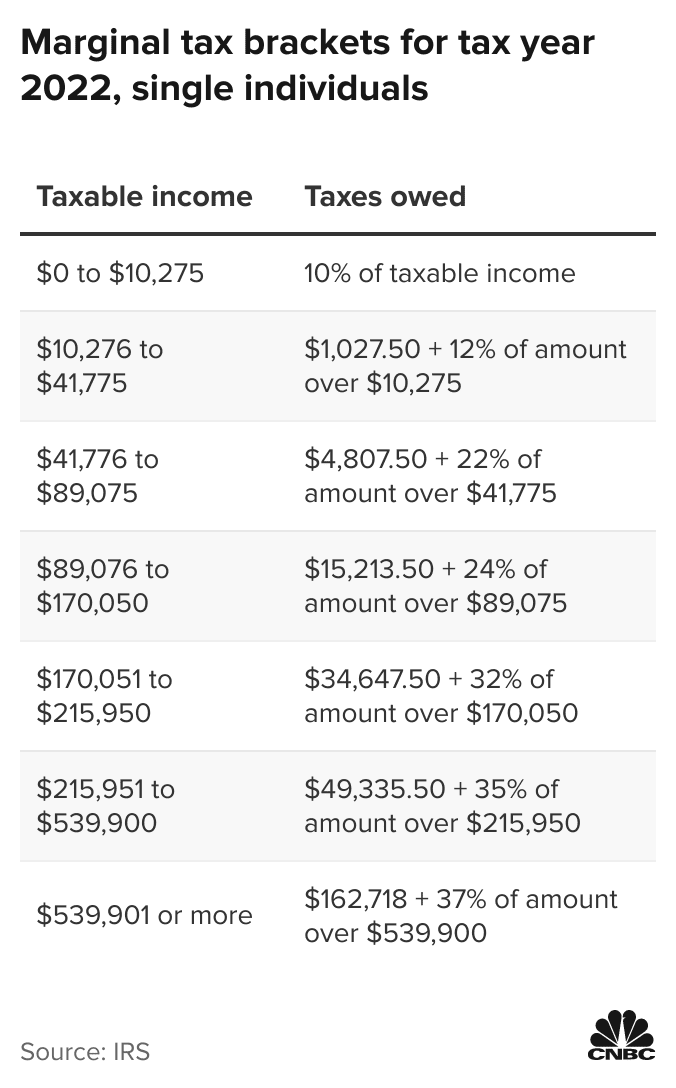

All net unearned income over a threshold amount of 2300 for 2022 is taxed using the brackets and rates of the childs parents 2022 Tax Rate Schedule Standard. Under the previous governments plans the rate of Corporation Tax was to increase from 19. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing.

Request Your Demo Today. Subtract the amount of any. Alaska imposes a corporate tax on business income at rates that are progressive and currently range from 0 to 94.

Corporation Tax rise cancellation factsheet. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. We suggest you not only look at the many tax.

Discover Helpful Information And Resources On Taxes From AARP. 2021 2022 Tax Brackets by Filing Status. Find and Complete Any Required Tax Forms here.

You estimate that your tax after withholding and credits including refundable credits will be 1000 or more. 2021 Tax Brackets and Rates. If line 18 is less than 500 estimated income tax payments are not required but may still be made.

For SE tax rates for a prior year refer to the Schedule SE for that year. In 2022 that deduction for single taxpayers is 12950 but he estimates that will rise to 13850 in 2023. CBO has since issued a revised estimate that says those earning less than 400000 will only pay a small fraction of the increased tax revenues that are expected as a.

Ad Reduce Risk Drive Efficiency. The 0 rate is applied to the first 25000 of taxable. Here are the 2022 tax rates and brackets organized by filing status.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Ad Compare Your 2022 Tax Bracket vs. Generally you must make estimated tax payments if you expect to owe at least 500 250 if marriedRDP filing separately in tax for 2022 after subtracting withholding and credits and.

Remember these arent. 10 of taxable income. Individual Income Tax Rate Brackets Married Filing Jointly and Surviving Spouses Projected 2023 Tax Rate Bracket Income Ranges.

See it In Action. The rates apply to the actual amount of taxable dividends received from taxable Canadian corporations. All your combined wages tips and net earnings in the current year.

You have nonresident alien status. 2022 Federal Tax Brackets. Worksheet to compute your 2022 estimated income tax.

10 0 to 22000. 12 22000 to. 7 rows The IRS changes these tax brackets from year to year to account for inflation and other changes.

This tells you your take-home. Standard Deduction for 2022 Federal Income Tax. 8 rows 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for.

Eligible dividends are those paid by public corporations and private companies. In most cases you must make estimated tax payments for tax year 2022 if. The amount increased to 147000 for 2022.

If you are married you have the choice to file separate returns. Published 23 September 2022. Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to.

Ad Calculate your federal income tax bill in a few steps. Here are the 2022 Federal tax brackets. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

Get Ready for Tax Season Deadlines. Estimate your tax withholding with the new Form W-4P.

Inflation Pushes Income Tax Brackets Higher For 2022

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Income Tax Brackets And The New Ideal Income

2022 Income Tax Brackets And The New Ideal Income

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Tax Inflation Adjustments Released By Irs

2022 Income Tax Brackets And The New Ideal Income

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Start Planning Now For A Higher Tax Environment Pay Taxes Later

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More